|

|

|

|

|

L A N D, Taxes & Poverty ... |

... without a knowledge [of the law of rent], it is impossible to understand the effect of the progress of wealth on profits and wages, or to trace satisfactorily the influence of taxation on different classes of the community. ... without a knowledge [of the law of rent], it is impossible to understand the effect of the progress of wealth on profits and wages, or to trace satisfactorily the influence of taxation on different classes of the community.

– David Ricardo (1772-1823) "Ricardo's Law"

"The weakness at the heart of the capitalist economy,

which is structured to shove entrepreneurship aside

in favour of speculation which generates the maximum

gains out of land. That is the Achilles heel of capitalism."

– Fred Harrison, (2010) "When's the Next Property Crash?"

Excerpt:

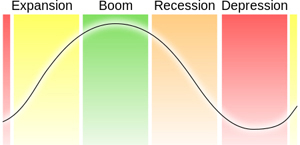

Finally, relevant analysis of what caused the Depression of 2010. And since the cause was exclusively related to the economics of the land market, which brought the last business cycle to an end, this inevitably leads to the question: Will the next cycle also be driven by a land-led boom/bust?

The onset of the new realism began when Martin Wolf analysed my book 2010: The Inquest in the Financial Times (July 8). He summarised the mechanism that drives the economy to distraction in these terms:

“Buyers rent property from bankers, in return for a gamble on the upside. A host of agents gain fees from arranging, packaging and distributing the fruits of such highly speculative transactions. In the long upswing (the most recent one lasted 11 years in the UK), they all become rich together, as credit and debt explode upwards. Then, when the collapse comes, recent borrowers, the financial institutions and taxpayers suffer huge losses. This is no more than a giant pyramid selling scheme and one whose dire consequences we have seen again and again. It is ultimately, as Mr Harrison argues, a ruinous way of running our affairs.”

That message has to sink into the heads of economists if they want to guide the western economy out of the depression. But there is a long way to go, as evidenced by the confusion in Britain’s Office for National Statistics (ONS). It reports that the UK only escaped the relapse into recession by the scale of government money pump-priming. But the figures were not disclosed for two weeks, without explanation for the delay. Something is awry in the numbers game, and the ONS won’t allay suspicions by explaining what was odd about its data. >>>more

How to calculate land value

with the land tax as a component value

Estimating

Land Values

by Ted Gwartney, MAI

Land Value Assessor (retired), Greenwich, Connecticut, USA

Excerpt:

The Nature of Land and Natural Resources

Characteristics of Land

Land, in an economic sense, is defined as the entire material universe outside of people themselves and the products of people. It includes all natural resources, materials, airwaves, as well as the ground. All air, soil, minerals and water is included in the definition of land. Everything that is freely supplied by nature, and not made by man, is categorized as land.

Land holds a unique and pivotal position in social, political, environmental and economic theory. Land supports all life and stands at the center of human culture and institutions. All people, at all times, must make use of land. Land has no cost of production. It is nature's gift to mankind, which enables life to continue and prosper.

Land's uniqueness stems from its fixed supply and immobility. Land cannot be manufactured or reproduced. Land is required directly or indirectly in the production of all goods and services. Land is our most basic resource and the source of all wealth.

Land rent is the price paid annually for the exclusive right (a monopoly) to use a certain location, piece of land or other natural resource. People receive wages for work, capital receives interest for investment, and land receives rent for the exclusive use of a location. Equity and efficiency require that the local general public, who created land value, should be paid for the exclusive use of a land site. That Payment is in the form of a land tax.

When considering world-wide economics, most people think that land rent contributes only a small insignificant portion of value. But as societies progress, land has become the predominant force in determining the progress or poverty of all people within a community. Land in major or cities is so costly that people are forced to move further away and travel great distances in order to get to work and social attractions. In the more developed countries of the world, land rent represents more than 40% of gross annual production. >>> more |

Back to top

PASSTAX explained:

Rates and land tax are notionally already in the gross rent paid by a tenant, and cannot be ‘passed on’ again to the tenant.

Introduction

by Bryan Kavanagh Land Valuer (ret) Australian Taxation Office.

Public capture of economic rent curbs land price bubbles. Therefore, replace taxation with public capture of economic rent to curb land price bubbles. ... The beneficial owner of land gets taxed, based upon its value—more correctly, pays the land’s annual net rent, because economic rents are not arbitrary taxes, as they cannot be passed on as taxes are. Therefore, there are virtually no deadweight costs flowing throughout the economy in prices under a system where land and natural resource rents are paid as an alternative to taxation. That part of the US property tax relating to land (not buildings) is actually economic rent. E.g. Houston, Texas, is a successful city which is attracting population and business, and has low median house prices because it has a high property tax (although it would be better if it taxed only the land values and not the buildings). If municipalities capture more publicly-generated land rent, there is less can be privately capitalised into high land prices, and taxes can be reduced concomitantly on businesses and workers. No more repetitive property booms and busts, because the lid is kept on real estate bubbles (which are basically land price bubbles).

A.

THE CLASSICISTS:

1 Though the landlord is in all cases the real contributor, the tax is commonly advanced by the tenants, to whom the landlord is obliged to allow it in payment of the rent.

– Adam Smith "Wealth of Nations" Book 5, Ch 2

2 A tax on rent falls wholly on the landlord. There are no means by which he can shift the burden upon anyone else... A tax on rent, therefore, has no effect other than the obvious one. It merely takes so much from the landlord and transfers it to the State.

– John Stuart Mill (1806-1873) "Principles of Political Economy" Book 5, Ch 3, Sect 2

3 The power of transferring a tax from the person who actually pays it to some other person varies with the object taxed. A tax on rents cannot be transferred. A tax on commodities is always transferred to the consumer.

– Professor James E Thorold Rogers "Political Economy" 2nd ed Ch 21, p 285

4 A tax levied in proportion to the rent of land, and varying with every variation of rents... will fall wholly on the landlords.

– Walker's "Political Economy", p 413

5 The incidence of the ground tax, in other words, is on the landlord. He has no means of shifting it; for, if the tax were to be suddenly abolished, he would nevertheless be able to extort the same rent, since the ground rent is fixed solely by the demand of the occupiers.

The tax simply diminishes his profits.

– ERA Seligman "Incidence of Taxation" pp 244-245

6 A tax on rent would affect rent only: it would fall only on landlords and could not be shifted. The landlord could not raise the rent, because he would have unaltered the difference between the produce obtained from the least productive land in cultivation and that obtained from land of every other quality.

– David Ricardo, Principles of Political Economy and Taxation (1817),

Ch 10, Sect 62

7 The way taxes raise prices is by increasing the cost of production and checking supply. But land is not a thing of human production, and taxes upon rent cannot check supply. Therefore, though a tax upon rent compels owners to pay more, it gives them no power to obtain more for the use of their land, as it in no way tends to reduce the supply of land. On the contrary, by compelling those who hold land for speculation to sell or let for what they can get, a tax on land values tends to increase the competition between owners, and thus to reduce the price of land. – Henry George, Progress and Poverty (1879), Book 8, Ch 3

B.

SOME MODERN ECONOMISTS

1 Pure land rent is in the nature of a "surplus" which can be taxed without affecting production incentives.

– Paul A Samuelson, Hancock & Wallace, Economics - An Introductory Analysis (Australian Edition) Ch 28 p 595

2 .... the complete inelasticity of the supply of land means that a tax on land rent has no effect on price or output and therefore does not alter resource allocation...This outcome is in contrast to property taxes on buildings.

– Jackson & McConnell, Economics, 2nd Aust Ed pp 540-541

3 The (land) tax cannot be passed on to consumers... The failure of the single tax idea does not change the fact that a large increment of value does accrue to the owners of land, particularly in or near urban areas, due to the growth of the economy, without the landlord having to contribute any productive factor services in order to earn it.

– Richard G Lipsey, An Introduction to Positive Economics (3rd ed.)

4 Aside from its compelling appeal to the public's sense of justice, a single tax on land has another advantage over most other forms of taxation - it is neutral in its effects on production incentives and resource allocation.

– Waud, Hocking, Maxwell & Bonnici, "Economics" (Australian Edition)

C.

SO, FOR THE SAKE OF EFFICIENCY AND GREATER HOUSING AFFORDABILITY, WHY NOT PUT MORE REVENUE WHERE IT ULTIMATELY FALLS ANYWAY?

It is in vain in a country whose great fund is land to hope to lay the publick charge of the Government on anything else; there at last it will terminate. The merchant (do what you can) will not bear it, the labourer cannot, and therefore the landholder must: and whether he were best to do it by laying it directly where it will at last settle, or by letting it come to him by the sinking of his rents, ... let him consider.

– John Locke, (1691) Some Considerations of the Lowering of Interest.

|

Back to top

Back to top

Why haven't economists eliminated poverty?

Symptoms of economic suffering and injustice have reached 'developed' countries, with wide-spread poverty, health crisis, political unrest, and war. The cause of the economic crisis is also the cause of the energy and ecological crisis which is impacting quality of air, soil, water and food.

WAR is usually about confiscation of resources - land, minerals, etc., resulting in catastrophic involuntary displacement. The number of homeless (landless) people– refugees, asylum seekers, and internally displaced people worldwide, has exceeded 65 million for the first time since World War II.

The World Bank Group (WBG) is "required" to identify and monitor "Involuntary displacement" caused by environmental degradation, natural disasters, conflicts or development projects.

World Bank Group policy "prescribes" compensation and other resettlement measures to achieve its objectives and requires that borrowers prepare adequate resettlement planning instruments prior to Bank appraisal of proposed projects.

>>> more

The Costs of War

A new report from Brown University on the 'costs' of war since 9/11.

"This spending has largely been financed by borrowing. Unless the US changes the way it pays for the wars, future interest will exceed $8 trillion by the 2050s."

Overview:

The Costs of War Project, housed at Brown University, was launched by a large group of scholars and other experts in order to document the hidden or unacknowledged costs of the post-9/11 wars in Iraq and Afghanistan, and related violence elsewhere in the “war on terror.” The project has issued, among other reports, the most comprehensive recent estimates of the human toll and US budgetary costs of these wars. >>> more

SUMMARY

– Over 480,000 have died due to direct war violence, and several times as many indirectly

– Over 244,000 civilians have been killed as a result of the fighting

– 21 million — the number of war refugees and displaced persons

– The US federal price tag for the post-9/11 wars is over $5.9 trillion dollars

– The US government is conducting counterterror activities in 76 countries

– The wars have been accompanied by violations of human rights and civil liberties, in the US and abroad

About the author, Steven Aftergood, Federation of American Scientists

Steven Aftergood directs the FAS Project on Government Secrecy, which works to reduce the scope of national security secrecy and to promote public access to declassified government information. He writes Secrecy News, which reports on new developments in secrecy policy and provides direct access to significant official records that are otherwise hard to find. Mr. Aftergood has been the plaintiff in Freedom of Information Act lawsuits against the Central Intelligence Agency and the National Reconnaissance Office which resulted in the release of intelligence budget records. >>> more

Like everything important, it's actually very simple...

"If we are born with equal rights, why are some people rich, while most people are poor? It is really about justice – economic justice. Social justice is a worthy aim, but without economic justice it is unattainable. There is a fairer way to share the earth’s bounty, so that the widening gap between rich and poor can be closed."

– Leo Foley, 2011, elected Alderman, Hobart City Council, Tasmania, AU.

|

United Nations General Assembly

ISSUE IN FOCUS

– “Housing is a RIGHT, not a commodity”

– “The vast amount of wealth has left governments accountable to investors rather than their international human rights obligations.”

Special Rapporteur on adequate housing as a component of the right to an adequate standard of living, and on the right to non-discrimination in this context.

See the report overview here

Download the official 2011 report in pdf format here. |

Back to top

When you've paid your rent,

you've paid your taxes.

If governments would collect their necessary revenue in the form of site rents, resource rents, monopoly rents and licence rents —all of which, by reason of their origin, accrue preferentially to the rich — they would not find it necessary to impose 'progressive' taxes on earned income.

— Dr Gavin Putland, Land Values Research Group

Though the landlord is in all cases the real contributor, the tax is commonly advanced by the tenants, to whom the landlord is obliged to allow it in payment of the rent.

— Adam Smith Wealth of Nations Book 5, Ch 2

A tax on rent falls wholly on the landlord. There are no means by which he can shift the burden upon anyone else... A tax on rent, therefore, has no effect other than the obvious one. It merely takes so much from the landlord and transfers it to the State. — John Stuart Mill (1806-1873)

Principles of Political Economy Book 5, Ch 3, Sect 2

Perfectly understated –

A closer look at what has gone on suggests that

a large fraction of the increase in wealth

is an increase in the value of land,

not in the amount of capital goods.

— Professor Joseph Stiglitz, Dec. 2014

|

SHARE The EARTH

(Aonymous)

On the central role 'space' plays in our economy.

Our economic system doesn't recognise the central role 'space' plays in our economy. Adam Smith understood it…

David Ricardo understood it…

More than anyone else, Henry George understood it...

So we can use all the energy we want - but we can only use the space we have. There is no way to get around it.

The central component of our economy is...

LAND

So if you want to make the world a better place, or a better "space" you'd better get your head around that.

Take famines for example.

We all know that some people starve to death.

Right now, at this very second, a child is dying from malnutrition.

Is it a problem of food resources?

No. It's a problem of distribution.

What do we use to distribute resources?

ECONOMICS

So, until we get the land question right, the world will never make sense. People will die of hunger, eco-systems will be destroyed in the name of progress. Entire species will be wiped out and one day that species will be us.

But we already have the solution. It's actually very simple!

SHARE THE EARTH

|

Back to top

Back to top

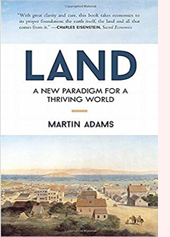

LAND – A New Paradigm For a Thriving World

by Martin Adams (2015)

Summary Summary

Many of us already sense on one level or another that capitalism creates inequality and also engenders the ecological destruction of our planet. What we don’t seem to understand is why: For example, why does the economic system we call capitalism lead to financial insecurity for many, even for those who, by all accounts, shouldn’t have to worry about money? And why exactly are we destroying our planet in our frantic conversion of nature into digits and little bits of paper we call money?

One of the main reasons our current form of capitalism is no longer working is because the commons—the gifts of nature—have been privatized. This privatization of nature is one of the root causes of economic recessions, ecological destruction, as well as social and cultural decline.

All of nature is community wealth, including—and especially—land. People give value to land through the goods and services they provide to their communities.

For example, because people offer more goods and services in the city than in the countryside, urban land tends to be much more expensive than rural land. As communities become more attractive to live in, some property owners—mostly the financial institutions that finance them —then extract this value by making money from real estate (buildings, like cars, decrease in value, but land increases in value the more valuable a community becomes), and this extraction is one of the root causes of wealth inequality, ecological destruction, and even economic recessions.

Land—even undeveloped land—costs a lot of money in our society. Why is that? It’s because land has an intrinsic value to human beings: We all need land. And because we all need land, those that own land can make money by buying and selling land at the expense of other people who have to pay money to live on it. Under our current land ownership model, property owners only pay other property owners for land as well as the banks that finance property ownership.

While land can certainly be privately used, its value is created by the community and therefore belongs to the community. Land has to be owned in common, and whenever people use land, they need to reimburse their local communities for their exclusive use of it.

They can do this by making community land contributions for the land they use. A land contribution approximates the market rental value of land, and the rental value of land is a measuring stick that reveals the financial value of the benefits that land users receive from their exclusive use of land. In most nations around the world, land has already been privatized: If communities were to suddenly impose land contributions upon existing property owners, property owners would end up having to pay twice for their ownership of land—first to the previous landowner (from whom they bought land), and a second time to their local communities.

In order to transition from a land ownership model to a land stewardship model local governments and community land trusts would either have to financially compensate existing property owners for the land value portion of the properties in question or cancel their existing mortgage debts. Land users would then be required to share the value of land with all members of their community through community land contributions. And finally, these contributions would then have to be redistributed to all community members in the form of a Universal Basic Income to prevent gentrification, reduce wealth inequality, and create a truly fair economy for all participants. >>> more |

Back to top

Science explains and understands the world of matter;

philosophy explains and understands the world of spirit.

Economics is the meeting place of these two worlds.

Whilst the immediate concern of economics is policy in the “world of matter”, the key participant in economic life is the human being, whose ultimate purpose of participation is to do with the “world of spirit”. Hence economics meets these two realms, stands at their interface. Its task is to ensure the rule of justice.

— Dr John Tippett, A Philosophers Take on Economics (2012)

|

Political Economy has been called the dismal science, and as currently taught, is hopeless and despairing. But this, as we have seen, is solely because she has been degraded and shackled; her truths dislocated; her harmonies ignored; the word she would utter gagged in her mouth, and her protest against wrong turned into indorsement of injustice. Freed, as I have tried to free her-in her own proper symmetry, Political Economy is radiant with hope.

— Henry George, Progress and Poverty (1879) |

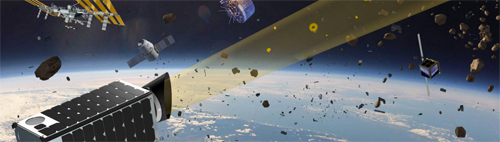

1. Who's in Charge of Outer Space?

All extraterrestrial activity today is governed by a 50-year-old, Cold War-era treaty. Will governments agree on an update before the final frontier becomes the Wild West?

By Adam Mann

May 19, 2017

Excerpt: … In March, Goldman Sachs announced to investors that a single asteroid containing $25 billion to $50 billion of platinum could be mined by a spacecraft costing only $2.6 billion—less than a third of what has been invested in Uber.

“While the psychological barrier to mining asteroids is high,” the Goldman report concludes, “the actual financial and technological barriers are far lower.” In April, NASA selected Trans Astronautica Corp., an aerospace company based in Lake View Terrace, Calif., for $3.25 million in technology study grants. Among TransAstra’s NASA-approved projects: an asteroid-hunting telescope whose stated mission is “to start a gold rush in space.”

The final frontier is starting to look a lot like the Wild West. As more companies announce ambitious plans to do business beyond Earth, serious questions are emerging about the legality of off-planet activity.

Everything that happens in space falls under the purview of the Treaty on Principles Governing the Activities of States in the Exploration and Use of Outer Space, including the Moon and Other Celestial Bodies. This international agreement, also known as the Outer Space Treaty, turned 50 years old in January. More than 100 countries, including the U.S., Russia and China, are parties to the treaty. “It’s the Constitution and the Magna Carta of space law,” says Sagi Kfir, general counsel for Deep Space Industries, an asteroid-mining company based in Mountain View, Calif. “It’s so fundamental that its principles have become customary international law even for those countries that aren’t signatories.” ...

The treaty declares the moon and other celestial bodies to be res communis, meaning they exist for the common good and belong to no one. Michael J. Listner, an East Rochester, N.H., lawyer with a specialty in space policy, says the res communis designation means resources found in outer space aren’t for the taking. “Everybody can use the resource of a local park,” Listner says, “but they can’t just chop down a tree and walk away with it to build their house.” >>> more |

Back to top

The case for a new form of democracy

based on human rights to the earth as a birthright.

Public Finance Based On Early Christian Teachings

by Alanna Hartzok, Co-Director, Earth Rights Institute and UN NGO Representative, Christianity and Human Rights Conference

Samford University, Birmingham, Alabama

November 2004

This paper makes a case for a new form of democracy based on human rights to the earth as a birthright, linking this to the Judeo-Christian Jubilee Justice tradition and Old and New Testament teachings. It presents a tax fairness practical policy approach based on the ethical stance of these teachings.

The United Nations Millennium Declaration was adopted by the world's leaders at the Millennium Summit of the United Nations in 2000. Secretary General Kofi Annan has said that the Declaration "captured the aspirations of the international community for the new century" and spoke of a "world united by common values and striving with renewed determination to achieve peace and decent standards of living for every man, woman and child." >>>more |

|

Back to top

Go To: Real Estate and Banking Cycles |

|

|

|

|