The Australian Tax Office (ATO) was established in 1910 under laws specifically designed for collection of Economic Rent via a Federal Land Tax.

(Archival document: Land Tax Act 1910 - (pdf).

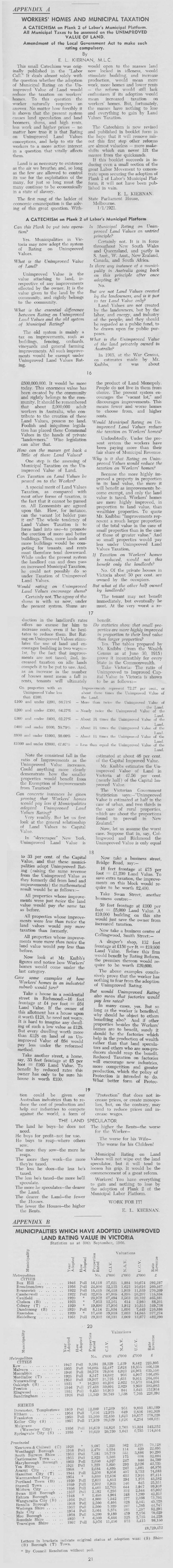

"Is Municipal Rating on Unimproved Land Value an untried principle?

Certainly not. It is in force throughout New South Wales and Queensland, and partly in S. Aust., W. Aust., New Zealand, Canada, and South Africa.”

– E.L. Kiernan M.L.C, 1921

Land tax in the State of Victoria

Debate in Legislative Council 19th November, 1919: Hansard No. 20 (pdf)

(Bill read first time 29th July, 1919)

The Hon. E. L. Kiernan moved the second reading of this Bill: "This Bill should not require a great deal of discussion. It’s object is to amend the Rating on Unimproved Values Act 1915. That Act contained one section which has prevented municipalities taking advantage of it."

How Victoria Adopted Site Value Rating

by A. R. Hutchinson, B. Sc. A.M.I.E. Aust.

October, 1962

Download the 24 page pamphlet in pdf format here:

(See screen-capture: p. 15 - 21 below)

Excerpt from Forward

The years since World War II have seen a remarkable growth in the numbers of Victorian municipalities which have abandoned local taxation of buildings and other improvements and have turned to the rating of the site-value (unimproved land value) instead for their local revenues. …

This rapid recent growth makes it timely to review the steps by which ratepayers secured the right of self-determination in the system by which their rate payments are computed.

An Act had been passed on 3rd February, 1914, to provide for optimal powers to make this change. This was the culmination of the efforts of many people but there was one fatal blemish. The measure was not to come into operation until proclaimed by the Governor in Council and this was not done until the value of land were assessed over the whole State under the Land Tax Act 1910 and available for use by municipalities. These were not forthcoming and indeed are not available from that source even today, some 48 years later. By 1919 it was evident that unless other means were provided to enable municipal councils to make their own valuations this praiseworthy Act would remain a dead letter.

To Hon. E. L. Kiernan is due the credit of introducing the small but vital measure needed, as a private member’s Bill, and pressing it through Parliament with the blessing of all parties. This was indeed an achievement and it is encouraging to read the tone of the various members’ speeches during the progress of the debates as recorded in the Hansard extracts which follow.

Hon. E. L. Kiernan's contribution did not cease with success in getting the vital measure carried. … (pp.1-2)

The benefits of Land Value Tax

by The Hon. Esmond Laurence Kiernan M.L.C.

1/1/1921,

State Parliament House, Melbourne

Scan: p. 15 - 21:

Go To: Australian Tax System - Past & Future

Back to top

|