by Maireid Sullivan

2011, updated 2024

Introduction

The Problem

Part 1

Solution 1 - Australia

- Eliminate taxes on productivity

Part 2

Solution 2 - Ireland

Part 3

Solution 3 - United Kingdom

- Location Value Covenants (LVC)

- Land Value Capture and Tax Increment Financing

- Covenant vs Mortgage

Part 4

Solution 4 - United States

- The Private-Investment Community Land Trust

Part 5

Setting Priorities

- Historic

Solution

- Origins of Classical Political Economic Theorem

- Solutions from the "Progressive Era" (1890-1920)

- RCC anti-Land Tax Campaign |

Health, Habitat, Economic Security:

"The Triple Bottom Line"

"To become fully human, people have lower order needs that in general must be fulfilled before high order needs can be satisfied: Five sets of needs - physiological, safety, belongingness, esteem, and self-actualization."

– Abraham Maslow, 1943, "Pioneering the Science of Happiness through the Hierarchy of Needs."

"When you've paid your Rent,

you've paid your taxes.

If governments would collect their necessary revenue in the form of site rents, resource rents, monopoly rents and licence rents —all of which, by reason of their origin, accrue preferentially to the rich— they would not find it necessary to impose 'progressive' taxes on earned income."

– Dr Gavin Putland, 2013

"Government 'of the people, by the people and for the people' requires public capture of Economic Rent– the whole Rent, and nothing but the Rent."

- Maireid Sullivan, 2011 |

The Problem

"If you don't tax that value that attaches to land, arising from the general wealth of the economy, the banks get it. . . the financial sector, the banks, are pretty much running the country." – Professor Michael Hudson

"There is a big discovery to be made, and this lies in an epochal change

- the rediscovery of Economic Rent. Surely, after all, it is civilisations that fail to evolve by not correcting their mistakes that die."

– Bryan Kavanagh, Australian Taxation Office (ATO) Land Valuer (Ret.)

'Home ownership' carrot:

"If you wanted to reduce the unpopularity of the property tax,

the way to do it would simply be to provide for an effective method

whereby it could be withheld at source, in small payments,

and that would eliminate a large part of the objection to it."

– Milton Friedman (1912-2006), from his 1978 lecture, "Is Tax Reform Possible?"

Eliminate taxes on productivity:

Instead, tax 'private' access to land, resources, and "negative externalities".

The social and economic ills besetting the world are the result of non-conformance to natural law: All people have a right to the use of the earth and all have a right to the fruits of their labor; a fairer, more egalitarian society.

By eliminating taxes on 'everything' except land and natural resources, we will achieve individual liberty, limited government and free markets.

During the transition, we can restrict taxes to socially generated values but quickly graduate to fees, leases, dues, etc.

The AIM: Tax private use of land and resources, and ...

• Take taxes off improvements

• Take taxes off labor

• Take taxes off people

• Take taxes off income

• Take taxes off wages

• Take taxes off business and industry

Social and economic benefits:

-

Removal of taxes on productivity will encourage innovation.

-

No more income tax accounting or reporting.

-

Removing land from speculative growth cycles will provide affordable land

(and homes) for everyone.

-

No need for a bank mortgage to access land.

-

A 'Citizen Dividend' of 'Basic Income' (equal distribution of annual consolidated revenue surplus) would support vocational choices with free education.

-

End needless suffering, poor health, and the misery of involuntary poverty.

"There is a big discovery to be made,

and this lies in an epochal change."

– Bryan Kavanagh, ATO Land Valuer

In my unpublished 18 April 2008 filmed interview, Bryan Kavanagh

(Australian Taxation Office Land Valuer) spoke of the implications, for the whole of society, of "The Law of Rent Theorem" - by collecting Economic Rent / Resource Rent instead of income and business taxes:

Excerpts:

When it comes to economics, the reintegration of the theory of land valuation is essential. It’s the new frontier —just as we sent Voyager out to explore space.

We're at a turning point where the economy is not working for us. There is a big discovery to be made, and this lies in an epochal change—the rediscovery of Resource Rent: Shifting —transferring taxes to Resource Rent is going to open the way for a whole new development for humanity.

The implications for humanity are greater freedom, more time for relaxation, for family, more time for the arts, and far less government control of our lives. These ideas might sound mystical, but they are the sorts of solutions that could be delivered to us, once we pass through this new frontier.

It's not just land rents we want to capture.

We want to capture licenses for electromagnetic spectrum, aircraft slots, all forms of forestry and mineral licenses, all resources. These would supplement our charges on land values, and add to the enormous Resource Rent pot, that is now 285 billion—more than our current [Australia 2008] level of tax revenue.

We've witnessed the progressive loss of a sense of community, and land rents represent community.

If we collected Resource Rent, we'd get rid of poverty.

We have a widening gap between wealthy and poor because the wealthy are capturing Resource Rent.

We've got to rediscover the land tax system.

This would open up enormous benefits: It would fund infrastructure, education, health, all of these areas that are crying out for funds, and this fund is sitting there, being grossly capitalized by individuals and causing us to ratchet up taxes to fund them. But if we decrease taxes, and capture more of the Resource Rent, we would be doing as nature intends us to do —using growing Resource Rent funds for public purposes.

– Bryan Kavanagh, 18 April 2008, Melbourne

|

From the mid-1700s into the 1800s:

Adam Smith's "An Inquiry into the Nature and Causes of the Wealth of Nations" (1776) - aka "Wealth of Nations" and David Ricardo's "Law of Rent Theorem" (1809) followed the French Physiocrats reasoning in formulating a win-win method of implementing natural law 'rights' - (detailed under Part4, Economic History):

In 1758, Royal physician and economist Francois Quesnay's (1694-1774), "Tableau Oeconomique" documented the Physiocrats' precept,

"the wealth of nations was derived solely from the value of land agriculture or land development" which led to a more logical reasoning;

That Economic Rent must be shared with the community as public revenue, and that all taxes on labor and the fruits of labor be abolished.

– Tax 'shelters' such as NGOs, foundations, and offshore tax 'havens' would no longer be needed.

– Collection of Economic Rent would provide funding for all public services and infrastructure, and a "Citizen Dividend" aka Universal Basic Income (UBI) representing equal 'shares' of annual consolidated revenue surpluses.

– Sustainable clean energy solutions are waiting for permission to emerge. There are many innovative solutions for provision of additional public services. E.g. the "dirty work" could be managed via National Service programs.

|

Economic Rent Explained!

Recommended reading: "Tax bads not goods"- Frank deJong's Economic Policy Resolution, Presented to the Green Party of Canada Economic Forum, March 2010 |

Part 1

Solution 1 - Australia

Back to top

Background

- Australia was Federated in 1901:

The Australian Taxation Office (ATO) was launched in 1910 on the Land Tax System; Income taxes were introduced to fund WWI.

(See detailed historical timeline references under Australian Tax System.)

2007

In May 2007, Australian Taxation Office Land Valuer Bryan Kavanagh published the results of his study on the long-term effects of property bubbles: "Unlocking the Riches of Oz: Case Study of the Social and Economic Costs of Australian Real Estate Bubbles, 1972-2006" (2007)

Download the report (pdf).

How to 'share the wealth' -

According to Mr Kavanagh's study, collection of half of Australia's Resource Rent, aka Economic Rent, would allow the Australian federal government to remove all taxes on productivity, i.e. income tax, sales tax, pay roll tax - ending the need to report 'enterprise' profits to the ATO.

1. Sufficient funds for all public services and public infrastructure, including free education and health care.

2. At 2007 value, equal distribution of annual consolidated revenue surplus would provide a tax-free 'Citizen Dividend' of between AUD$34,000. and AUD$49,000, which can replace all welfare, social security, and unemployment payments.

Why should everyone receive a "Citizen Dividend"

aka Universal Basic Income (UBI)?

We all become equal 'Global Commons' shareholders when 'Economic Rent' for private access to 'The Commons' is paid into a national Consolidated Revenue Fund: When all government services have been funded, we are eligible to collect an equal share of the annual Consolidated Revenue Fund SURPLUS.

2007

Following the August 2007 stock market crash, which led to the 2008 GFC:

– November 2007, Labor Party leader Kevin Rudd was elected Prime Minister of Australia.

– December 2007, Kevin Rudd was sworn in as the 26th Prime Minister of Australia.

PM Rudd's first 'directive' to Australian Treasury Secretary, Dr. Ken Henry, led to the tax policy review:

Australia's future tax system (2010).

“One reason why fiscal federalism is so important to this review is that, notwithstanding the fact that the well-being of taxpayers is affected by the entire federation's tax-transfer system, past tax reviews tended to focus on improving the taxes only of the government that commissioned the review.” - Dr. Ken Henry's 19 August, 2009 speech, Taxation reform and fiscal federalism - Implications of Australia's Future Tax System Review

2008

"Land-based revenues are sufficient to allow total abolition of company and personal income tax," according to former Australian Treasury official Dr. Terry Dwyer, who undertook his PhD on the history of taxation theory at Harvard University.

"Most of us would like to have something for nothing. But the truth is we can't have that, so what we should do is to make sure our labour and our effort is untaxed and that the 'free ride' is enjoyed by us all collectively through the community, instead of making sure valuable natural resources end up in the hands of a select few who can grow fat on the labour of others." – Dr. Terry Dwyer, 2008

Dr. Dwyer's submission to the 2008 Australian Treasury Department review:

Australia's Future Tax System (AFTS)

LAND VALUE TAXATION: SOLVING THE EFFICIENT TAX PROBLEM

By Terry Dwyer, BA, BEc, MA, PhD (Harvard), Dip. Law., Visiting Fellow, Crawford School of Economics and Government, Australian National University.

LAND VALUE TAXATION

Replacing bad taxes with one good one

EXCERPT:

Edmund Burke's sober reflection is a reminder that in any tax reform there are winners and losers. However, while the reform of an existing tax system is perhaps more difficult than the simple introduction of a new tax, it does have the advantage that, in abolishing or reducing other taxes, one may please more people than those who are offended by the new tax.

It is often said that in economics there is no such thing as a free lunch. This is not always true. Where an economic change allows for greater efficiency and productivity, it is possible to come out ahead, and ensure that the gains of the winners exceed the losses of the losers.

See the Executive Summary HERE

2009

"Land Value Tax is efficient because the tax reduces the price of land but does not affect how it is used, or how much is used."

– Dr. Ken Henry, Treasury Secretary, Australian Gov. (2001-2011), author, Taxation reform and fiscal federalism - Implications of Australia's Future Tax System, 2009

2010

Celebrating the 100th anniversary of the Australian Taxation Office (ATO)

A turning point for 'moving forward' together:

- "Australia's Future Tax System"

Treasury Department Review, Final Report, 2 May 2010

"Stronger, fairer, simpler: a tax plan for our future"

- Prime Minister, the Hon. Kevin Rudd, MP, 2 May 2010 [pdf]

Dr. Henry's review confirmed the original intention of Australia's Founding Fathers following Federation in 1901 with the 1910 launch of the Australian Taxation Office (ATO): Collection of Economic Rent is the only efficient sovereign solution to detrimental effects of speculative real estate 'Boom-Bust cycles' and complicated tax avoidance schemes.

40 year projection

Australia's future tax system:

Parliament of Australia, Library Section Briefing, 2010

"As stated in the Report’s preface, the Review took a long-term perspective and intended the Report to be a guide for reform of the tax and transfer system in Australia to meet the challenges from the economic, social and environmental changes envisaged over the next 40 years. The 138 recommendations made in the report are therefore intended to be viewed in the medium to long-term perspective and not in the short-term context of a three-year Parliament." – Bernard Pulle, 2010, Senior Research Specialist at Parliament of Australia

Australia's Future Tax System, 2010

Excerpt:

The Australian Treasury Department tax review Australia's Future Tax System (2010), aka The Henry Review:

Henry Review Recommendations (Treasury 2010b)

C2 — Land tax and conveyance stamp duty

Recommendation 51: Ideally, there would be no role for any stamp duties, including conveyancing stamp duties, in a modern Australian tax system. Recognising the revenue needs of the States, the removal of stamp duty should be achieved through a switch to more efficient taxes, such as those levied on broad consumption or land bases. Increasing land tax at the same time as reducing stamp duty has the additional benefit of some offsetting impacts on asset prices.

Recommendation 52: Given the efficiency benefits of a broad land tax, it should be levied on as broad a base as possible. In order to tax more valuable land at higher rates, consideration should be given to levying land tax using an increasing marginal rate schedule, with the lowest rate being zero, with thresholds determined by the per-square-metre value.

Recommendation 53: In the long run, the land tax base should be broadened to eventually include all land. If this occurs, low-value land, such as most agricultural land, would not face a land tax liability where its value per square metre is below the lowest rate threshold.

Recommendation 54: There are a number of incremental reforms that could potentially improve the operation of land tax, including: a. ensuring that land tax applies per land holding, not on an entity's total holding, in order to promote investment in land development; b. eliminating stamp duties on commercial and industrial properties in return for a broad land tax on those properties; and c. investigating various transitional arrangements necessary to achieve a broader land tax.

Deputy PM Julia Gillard's Big Opportunity

- a Big Mistake!

Prime Minister Kevin Rudd's directive to the Treasury Department provided an historic opportunity to be prepared, but, instead, he lost his 'job' to Deputy PM Julia Gillard. Following massive international Murdoch-led advertising and lobbying by the Minerals Council of Australia, Julia Gillard's "private talks" with key members of the mining industry led to her agreement not to implement the Treasury Dept. recommendations if 'selected' Prime Minister.

The Treasury Department's recommendation was modified and renamed the Mining Resource Rent Tax (MRRT) following the appointment of Julia Gillard as Prime Minister of Australia in late June 2010.

(Detailed timeline references under Australian Tax System, Part 7.)

|

Part 2

Back to top

Solution 2 - Ireland

2012

Open Letter from nine Irish academics

In December 2012, nine Irish academics wrote the following open letter to the Editor, Irish Independent newspaper – concise AND comprehensive enough to make sense to those unfamiliar with the The Law of Rent theorem (Economic Rent, Land or Site Value Tax).

Why site value tax is best option

Open Letter to the Editor

Independent.ie

December 2, 2012

Madam – We the undersigned support the introduction of a property tax based on the unimproved value of all residential sites, and all zoned land, ie the value that has not been created by the landowner. A tax on the unimproved portion of property value is a Site Value Tax (SVT).

SVT is the most equitable, efficient and effective property tax option for the Government. Unlike a conventional property tax that taxes the 'improved' portion of the property, ie the buildings and thus penalises construction, SVT is non- distortionary, creates no economic drag and has minimal adverse effects.

By capturing unearned value at an early stage of the property development process, SVT discourages empty buildings, land speculation, hoarding and over-zoning and diverts capital and available credit into productive investment and sustainable jobs. In the long term, an SVT will moderate violent fluctuations in the property market and general economy.

SVT provides a stable base to fund vital infrastructure and services and offers a transparent link between the private benefits of public investment and the source of the investment.

SVT will reduce the property tax burden on homeowners by one-third by spreading the burden on to development land-owning individuals, firms and banks which were largely responsible for the current crisis.

– Peter Antonioni, Fellow, University College London;

– Bill Black, Associate Professor of Economics and Law, University of Kansas;

– Dr Micheal Collins, NERI (Nevin Economic Research Institute);

– Karl Deeter QFA, (LIAM) dip;

– Dr Constantin Gurdgiev, Adjunct Professor, Trinity College;

– Dr Stephen Kinsella, University of Limerick;

– Professor Brian Lucey, Trinity College;

– Dr. Ronan Lyons, Balliol College, Oxford;

– Dr Terrence McDonough, Economics, NUI Galway.

Update: 2022

Another mistake - Taxing 'houses' instead of land value:

The Irish Times view on property tax: the tax-averse left

Dublin City Council is wrong not to increase the levy

Irish Times, September 22, 2022

Since the local property tax was introduced in 2013, councillors have had the power to raise or lower the rate by 15 per cent.

>>>more

See more details on Ireland's Sovereignty Crisis . . .

|

Part 3

Back to top

Solution 3 - United Kingdom

2006

Cambridge, UK group offered viable options

|

Land Value Covenants vs Mortgages:

An option to switch from paying income taxes

to signing a "Covenant" on the locational value of your land - a Covenant which remains on the property's title.

|

Dr. Adrian Wrigley (2013 Obituary), "described as a polymath and an 'absolute genius' by friends and peers" gained a PhD in computer science at Cambridge University before launched the Systemic Fiscal Reform Group (SFR) in 2006 with his Land Covenant Mortgage briefing (2006). The Cambridge-based economics think tank studied "existing and alternative tax and welfare structures, their effectiveness and impact on the efficiency and stability of the economy."

SFR argued that the country's taxation and monetary system

is 'not fit for purpose':

Homes should be places to live, commercial property places to create wealth. Neither should be things of pure speculative profit or loss.

People should be free to work for themselves or others without the clamp of taxation or bureaucracy.

Government should be run as a business serving all citizens – its “shareholders”. It should not be a charity for bankers, landowners, the very wealthy or the poor.

|

SUMMARY

Policy Briefing

Systemic Fiscal Reform goals

Systemic Fiscal Reform (SFR) is a process of reform moving from the current tax, welfare and monetary system to one based on based on economic, financial and moral integrity. The endpoint of this process is a much more stable and productive society with the following features:

No Income or Corporation Taxes

– Replaced by payments pledged by property owners

Income Tax and Corporation Tax are to be phased out (along with all payroll taxes, National Insurance payments and Gains taxes). In their place, government will be funded by payments pledged by landowners through covenants established on a voluntary basis. These pledges are called Location Value Covenants (LVCs), and are inspired by or using the English legal instrument of land covenants.

No Value Added or Sales Taxes – Replaced by a Carbon Tax

VAT and sales taxes are to be abolished. In their place, a uniform Carbon Tax is levied on all extraction and importation of fossil fuels. This Carbon Tax is in proportion to the pollution and climate change potential of the fuel when used in the normal way.

No Estate (Inheritance), Gift, Transfer or Stamp Taxes

Estate taxes such as Inheritance Tax and Accession Taxes are to be abolished. All Stamp Duties are to be abolished, including those on share and real-estate transfers.

No means-tested welfare benefits – Replaced by a Citizens' Dividend

Welfare benefits based on poverty, joblessness tests or housing costs are to be abolished.

Any welfare payments based on disability are retained. >>> more

|

Covenants vs Mortgages

Back to top

2008

Local Value Covenants vs Mortgages

"the 'Prosperity Pill' we've all been looking for!"

Exemption from other taxes – that's the proposition –

– With a mortgage:

The money is created out of nothing by the banking system.

– With an LVC:

The money is created out of nothing by the government.

"Location Value Covenants are operated in a similar way to mortgages, and have the same kind of incentives, and even the same administration."

The key differences are: >>>more |

Back to top

2011

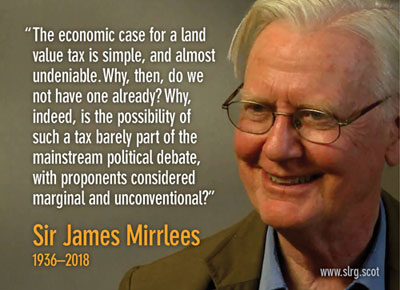

"Mirrlees Review"

"Tax by Design" - Mirrlees, et. al., 2011

"Reforming the tax system for the 21st century."

Mirrlees Review

The Mirrlees Review brought together a high-profile group of international experts and early career researchers to identify the characteristics of a good tax system for any open developed economy in the 21st century, assess the extent to which the UK tax system conforms to these ideals, and recommend how it might realistically be reformed in that direction.

The Review is published by Oxford University Press in two volumes. The first, Dimensions of Tax Design, consists of a set of specially commissioned chapters dealing with different aspects of the tax system, accompanied by a series of commentaries by different expert authors, voicing differing opinions on the issue discussed. The second volume, Tax by Design, sets out the conclusions of the Review.

The Mirrlees Review brought together experts to identify the characteristics of a good tax system for any open developed economy in the 21st century.

Both volumes are available to download free of charge here.

See special 2011 edition of Fiscal Studies on the Mirrlees Review here. |

Back to top

2018

European Journal of Sustainable Development Research (EJSDR)

Land Value Capture and Tax Increment Financing:

Overview and Considerations for Sustainable Urban Investment

by Simon Hugh Huston and Ebraheim Lahbash

EJSDR July 2018, 2(3), xx ISSN: 2542-4742

FULL Text

What is it about?

Funding gaps impel governments to seek alternative funding sources. Taxing in the 'unearned increment' of land which passively inflates due to population pressure and economic growth is an untapped infrastructure finance source.

Why is it important?

Climate change, health and unresolved inequality suggest a tempering of UK 'laissez faire' urban development model which, arguably, panders to developer vested interests. Sustainable development impels more upfront transport infrastructure compared to current 'mass housing' or 'dormitory' fossil-fuel orientated sprawl. LVC can help internalise urban development externalities so that land owners and developers pay their 'fair' share. However, circumstances vary and policy needs careful and informed calibration.

Perspectives

Dr Simon Hugh Huston, Coventry University

After years living abroad, one is struck by UK spatial policy failure, manifest by 1) the decrepit state of regional transport infrastructure and obvious funding needs 2) the comfortable complacency of UK elites (who seem to have pocketed land value uplifts without making any social or innovative contributions). Land Value Capture helps temper inequality, nudge community engagement and safeguard the future. Source |

Part 4

Solution 3 - United States of America

Back to top

The Private-Investment Community Land Trust:

A Better Way to Revitalize Communities

by Dan Sullivan

Excerpt

The Essential Concept

The private-investment community land trust is an alternative system for private land-holding, for generating community revenues, and for encouraging better land use. Essentially, land users lease the land, rather than purchase it, from a land trust. The trust then uses lease revenues to pay investors, to provide community services, to rebate taxes levied against occupants of trust land by larger taxing bodies, and to acquire additional land. It has many advantages over our traditional land tenure system, and particularly over urban-renewal projects, to the occupants, the investors, and the communities in which they are located.

Current Occupants Can Stay

People often complain that urban redevelopment projects create "gentrification," by which they mean pushing poorer people out in order to entice richer people to move in. The land trust approach attracts richer people and more dynamic businesses with little or no displacement of those already living or doing business in the community. Studies show that when a community gradually improves, it actually loses fewer residents than similar communities that stagnate or continue to decline. The real cause of displacement is the urban renewal project that is undertaken to trigger gentrification. Indeed, the original term for "urban renewal" was "slum clearance." >>> more

|

Part 5

Setting Priorities

Back to top

A shift in tax policy can rebalance:

– production and speculation

– environment and industry

– small and large business

– capital and labour

Affordable access to land and a home is key to psychological and economic sustainability.

"a longing for coming home to the sacredness of our belonging to the living body of earth and the joy of serving that at every step."

– Dr. Joanna Macy, (b. 1929-), Systems & Deep Ecology scholar

Collection of Economic Rent via a "Single Tax"

instead of taxing productivity would deliver:

– sustainable natural resource use

– a carbon inclusive economy

– affordable housing

– less urban sprawl

– self-financing public transport

– more income, less tax, less work.

– environmental protection

– a basic social wage/Citizen Dividend

– the end of poverty

|

So, why are we still in debt?

– 1. bank mortgage for access to land PLUS interest rates up to triple property value.

– 2. income and business taxes to fund government.

Under the "Economic Rent" model, a Land Value Tax (LVT) aka a "Single Tax" on the value of land and resources can fund government, including a basic income, replacing welfare, social security, and unemployment payments. |

Housing is a cost of living to wage earners

"Land only has a value (price) because the full economic rent is not being collected. The more economic rent (or land tax) that is collected the lower the price of the land. If the whole economic rent is collected the price of the land would be zero."

– Raymond Makewell, The Science of Economics (2013)

"To understand the mechanism that drove the global economy into depression, substitute 'land' for 'housing'. All the analyses refer to housing crises around the world, and the related financial symptoms like the sub-prime mortgage racket. But these terms are intended to disguise the site of the problem – the way in which we make money out of land without adding value to the wealth of our nations."

– Fred Harrison

"The management of the modern economy by the affluent for the affluent will fail."

– John Kenneth Galbraith

|

HISTORIC SOLUTION

The problems we face are not new.

Back to top

Excerpts from Part 4: A Short History of Economics

. . .

Confucius of Europe

Francois Quesnay (1694-1774) became known as “the Confucius of Europe” during his lifetime. Professor Wei-Bin Zhang quotes Maverick (1938) in Confucianism and Modernisation (2000),

The influence of the Chinese upon the physiocrats was probably more extensive and more significant than has generally been appreciated. If one will but look into the matter, he can readily discern similarities in thought on the part of Chinese sages and French économistes…. This similarity is more than mere coincidence; it is due to an actual borrowing on the part of the physiocrats. (Zhang, 2000, p. 195)

Two essential overviews:

– Judith A. Berling, 1976, Confucianism - an essay on neo-Confucianism.

– Professor Derk Bodde, 2005, Chinese Ideas in the West, (pdf): Overview of the role Confucian philosophy played in sustaining China's imperial status-quo.

The Physiocrats

Informed by China's 4000-year history of taxing land.

Centuries of turmoil brought France to the verge of bankruptcy.

Injustice and corruption were widespread. The need to prevent anarchy and maintain social order led to new ideas in political economy, out of which emerged the "économistes": A new school of economic thought launched the first strictly scientific system of economics, preceding the Classical Political Economists in acknowledging the importance of "Land" in terms of economic significance.

Recognising France as primarily an agricultural economy, the "économistes" modelled their 'solutions' on laws of nature, which led P. S. DuPont de Nemours to coin the term

"Physiocrats" – from the Greek, rule of Nature.

The school was dominated by Royal physician and economist Francois Quesnay (1694-1774) and economist and statesman Anne-Robert-Jacques Turgot (1727–1781), later joined by economist Jacques Claude Marie Vincent de Gournay (1712-1759) and writer, economist and government official Pierre Samuel du Pont de Nemours (1739-1817) who supported the revolution and advocated for genuinely free trade, and an end to feudalism: "Physiocrats called for the abolition of all existing taxes, completely free trade and a single tax on land."

– Fonseca, Gonçalo L., (2009), "The Physiocrats" (Archived)

... there arose in France a school of philosophers and patriots– Quesnay, Turgot, Condorcet, Dupont– the most illustrious men of their time, who advocated, as the cure for all social ills, the "impot unique", the "single tax". – Henry George, 1890, Justice the Object- Taxation the Means

In 1758, Francois Quesnay wrote "Tableau Oeconomique" documenting the Physiocrats' precept: "that the wealth of nations was derived solely from the value of land agriculture or land development."

The first English translation was in 1766 described as;

THE OECONOMICAL TABLE - An Attempt Towards Ascertaining and Exhibiting the Source, Progress, and Employment of Riches, with Explanations, by the friend of Mankind, the celebrated MARQUIS de MIRABEAU

Using the paradigm of an agricultural society, the Tableau traces the flow of production in a closed system. The unfortunate references to the barren (or sterile) advances for manufacturing or commerce were later used to discredit the analysis. But whether from a misapprehension over the peculiar terminology employed or a fundamental error of the school, the profound truths of the Physiocrats have been generally ignored. Still, Adam Smith who recognized the contribution of manufacturing and commerce had this to say of the Physiocrats in his An Inquiry Into the Nature and Causes of the Wealth of Nations

This system, however, with all its imperfections, is, perhaps, the nearest approximation to the truth that has yet been published upon the subject of political economy, and is upon that account well worth the consideration of every man who wishes to examine with attention the principles of that very important science. >>>more: University of New York/ Buffalo

|

Origins of Classical Political Economic Theorem

Back to top

The Wealth of Nations

Scottish social philosopher and political economist,

Professor Adam Smith (1723-1790), the reputed founder of Classical Political Economics, visited the Physiocrats in France while touring across Europe (1764-1766) as tutor to the young Scottish nobleman Henry Scott, 3rd Duke of Buccleuch. Smith was influenced by the Physiocrats' economic theorem: "the wealth of nations was derived solely from the value of land agriculture or land development."

Ten years later, Classical Political Economics theorem was formally launched with the publication of Adam Smith's

The Wealth of Nations (1776).

"The rent of land, therefore, considered as the price paid for the use of the land, is naturally a monopoly price. It is not at all proportioned to what the landlord may have laid out upon the improvement of the land, or to what he can afford to take; but to what the [tenant] can afford to give."

– Adam Smith, 1776, An Inquiry into the Nature and Causes of the Wealth of Nations, Book 1, Chapter 11, Of the Rent of Land

Note: Download Free copy (pdf) of Eamonn Butler, 2011, The Condensed ‘Wealth of Nations’ from The Adam Smith Institute

|

"The Law of Rent Theorem"

English Economist David Ricardo (1772-1823), around 1809, defined the income derived from the ownership of land and other free gifts of nature as "The Law of Rent" aka Ricardo's Law.

Collection methods are referred to as Economic Rent | Resource Rent | Land Value Tax | Site Value Tax | "The Single Tax":

A philosophy and economic theory that follows from the belief that although everyone owns what they create, land, and everything else supplied by nature, belongs equally to all humanity.

"... without a knowledge [of The Law of Rent], it is impossible to understand the effect of the progress of wealth on profits and wages, or to trace satisfactorily the influence of taxation on different classes of the community." – David Ricardo

However, some 150 years before Ricardo, Sir William Petty (1623-1687) applied what came to be known as Ricardo’s Law of Rent as the basis for the theory of land valuation. Famously, Sir William Petty used the principle of capitalisation of the rent of land to value England and Ireland. Australian Tax Office (retired) land valuer and researcher Bryan Kavanagh wrote about this obscure piece of Irish history in an article published in THE AGE Newspaper in 2005: Resource rents hold the property key and, in June 2012, Bryan Kavanagh also wrote, on his blog, about William Petty's valuation of England:

WHERE IT ALL GOES HORRIBLY WRONG:

Classical Days – When the role of land rent in the economy was understood.

With no disrespect for Adam Smith, some still see Sir William Petty (1623-1687) as the father of modern economics and its first econometrician. In many respects, I think Petty was the true founder of classical economics because he had an even deeper understanding of the role (and the sheer extent) of rent within the economy than Adam Smith. Being both a valuer and an economist, he had a much broader picture of the economy than today’s superficial economists.

– Bryan Kavanagh, Land Valuer (Ret.), Australian Tax Office and various Australian banks.

|

Solutions from the "Progressive Era" (1890-1920) still apply

Back to top

For the study of political economy you need no special knowledge, no extensive library, no costly laboratory. You do not even need text-books nor teachers, if you will but think for yourselves. All that you need is care in reducing complex phenomena to their elements, in distinguishing the essential from the accidental, and in applying the simple laws of human action with which you are familiar.

– Henry George, Progress and Poverty (1879) |

Progress and Poverty (1879)

by Henry George (1839–1897)

Read Progress and Poverty HERE

Excerpts

Production and consumption are only relative terms.

Speaking absolutely, people neither produce nor consume.

They cannot exhaust or lessen the powers of nature.

If the whole human race were to work forever, they could not make the Earth one atom heavier or lighter. Nor could they augment or diminish the forces that produce all motion and sustain all life.

Water taken from the ocean must eventually return to the ocean.

So too, the food we take from nature is, from the moment we take it, on its way back to those same reservoirs. What we draw from a limited extent of land may temporarily reduce the productiveness of that land. But the return will go to other land.

Life does not use up the forces that maintain life.

We come into the material universe bringing nothing; we take nothing away when we depart. The human being, in physical terms, is just a transitory form of matter, a changing mode of motion. From this, it follows that the limit to population can be only the limit of space — that the human race may not increase its numbers beyond the possibility of finding elbow room. Remote and shadowy as it is, this possibility is what makes Malthus' theory appear self-evident.

But there is still another difference:

Humans are the only animals whose desires increase as they are fed — the only animal that is never satisfied. The wants of every other living thing are fixed. The ox of today aspires to no more than the ox that humans first yoked. The only use they can make of additional supplies, or additional opportunities, is to multiply.

But not so humans. No sooner are our animal wants satisfied than new wants arise. The beast never goes further, but humans have just set their foot on the first step of an infinite progression.

Once the demand for quantity is satisfied, we seek quality.

As human power to gratify our wants increases, our aspirations grow. At the lower levels of desire, we seek merely to satisfy our senses. Moving to higher forms of desire, humans awaken to other things.

We brave the desert and the polar sea, but not for food;

we want to know how the earth was formed and how life arose. We toil to satisfy a hunger no animal has felt, a thirst no beast can know.

Given more food and better conditions, animals and vegetables can only multiply — but humans will develop. In the one case, the expansive force can only extend in greater numbers. In the other, it will tend to extend existence into higher forms and wider powers.

– Progress and Poverty, 1879

|

Back to top

Speech by Winston Churchill

Land and Income Taxes in the Budget

Edinburgh, July 17, 1909

Shared on Project Gutenberg

Excerpt: We are often assured by sagacious persons that the civilisation of modern States is largely based upon respect for the rights of private property. If that be true, it is also true that such respect cannot be secured, and ought not, indeed, to be expected, unless property is associated in the minds of the great mass of the people with ideas of justice and of reason.

It is, therefore, of the first importance to the country - to any country - that there should be vigilant and persistent efforts to prevent abuses, to distribute the public burdens fairly among all classes, and to establish good laws governing the methods by which wealth may be acquired. The best way to make private property secure and respected is to bring the processes by which it is gained into harmony with the general interests of the public. When and where property is associated with the idea of reward for services rendered, with the idea of recompense for high gifts and special aptitudes displayed or for faithful labour done, then property will be honoured. When it is associated with processes which are beneficial, or which at the worst are not actually injurious to the commonwealth, then property will be unmolested; but when it is associated with ideas of wrong and of unfairness, with processes of restriction and monopoly, and other forms of injury to the community, then I think that you will find that property will be assailed and will be endangered.

A year ago I was fighting an election in Dundee. In the course of that election I attempted to draw a fundamental distinction between the principles of Liberalism and of Socialism, and I said "Socialism attacks capital; Liberalism attacks monopoly." And it is from that fundamental distinction that I come directly to the land proposals of the present Budget.

It is quite true that the land monopoly is not the only monopoly which exists, but it is by far the greatest of monopolies; it is a perpetual monopoly, and it is the mother of all other forms of monopoly. It is quite true that unearned increments in land are not the only form of unearned or undeserved profit which individuals are able to secure; but it is the principal form of unearned increment, derived from processes, which are not merely not beneficial, but which are positively detrimental to the general public. Land, which is a necessity of human existence, which is the original source of all wealth, which is strictly limited in extent, which is fixed in geographical position - land, I say, differs from all other forms of property in these primary and fundamental conditions.

Nothing is more amusing than to watch the efforts of our monopolist opponents to prove that other forms of property and increment are exactly the same and are similar in all respects to the unearned increment in land. They talk to us of the increased profits of a doctor or a lawyer from the growth of population in the towns in which they live. They talk to us of the profits of a railway through a greater degree of wealth and activity in the districts through which it runs. They tell us of the profits which are derived from a rise in stocks and shares, and even of those which are sometimes derived from the sale of pictures and works of art, and they ask us - as if it were their only complaint -

"Ought not all these other forms to be taxed too?"

But see how misleading and false all these analogies are. The windfalls which people with artistic gifts are able from time to time to derive from the sale of a picture - from a Vandyke or a Holbein - may here and there be very considerable. But pictures do not get in anybody's way. They do not lay a toll on anybody's labour; they do not touch enterprise and production at any point; they do not affect any of those creative processes upon which the material well-being of millions depends. And if a rise in stocks and shares confers profits on the fortunate holders far beyond what they expected, or, indeed, deserved, nevertheless, that profit has not been reaped by withholding from the community the land which it needs, but, on the contrary, apart from mere gambling, it has been reaped by supplying industry with the capital without which it could not be carried on. >>>more |

|

RCC anti-Land Tax Campaign

Excerpt from Part 1, A Short History of Economics

1000 - 1400 AD

Owning Land "in perpetuity"

... the introduction of formal Separation of Church and State laws gave the Roman Catholic Church (RCC) authority over traditional laws around European family life and spiritual dogma, and the introduction of new laws defining land ownership based on the argument that since the Church is the "body of Christ" it is immortal, therefore, can own land "in perpetuity". |

• 1891AD

Rerum Novarum

The impact of this 1891 Encyclical by Pope Leo XIII echoed through the 20th Century and, for Catholics, dominated it, according to Professor Mason Gaffney's 1997 lecture, updated in 2000.

View in PDF format: Henry George, Dr. Edward McGlynn, and Pope Leo XIII

• 1931AD

[Rerum's] sequel, Quadragesimo Anno, 1931, was issued by Pius XI to steer a course between socialism and laissez faire, seeking 'social justice through social action' (p. 12)

"The 1931 encyclical put the verb into the 1891 encyclical."

– The Honourable Dr. Race Mathews MP

(quoted from my unpublished filmed interview, 29/11/2016).

Back to top

Go to: Various Perspectives

|

|