Land Tax is a tax on the value of the land, not on the land itself. The value of land is determined by the cost of publicly funded infrastructure and services around it: Land Value Tax

|

There is no shortage of roofing tiles.

There is no shortage of cement.

There is no shortage of window glass.

There is no shortage of house bricks.

There is no shortage of doors.

There is no shortage of insulation.

"The only crisis is the cost of access to land.

Tax-free-capital-gains-for-land-owners is the single flawed Government policy choice responsible for rendering land under houses unaffordable. Choosing Annual Ground Rent (AGR) or Land Value Tax (LVT) will make quality homes plentiful and affordable for us and our children – to either buy or rent.

By cancelling speculation in land, we can end the housing crisis- along with taxes on incomes and trade."

- Scottish Land Revenue Group (SLRG) |

"What gives urban land its value, apart form the few cents per square foot which the developer has to spend on roads, water and sewerage connection, is its proximity to opportunities for employment, shopping, education, etc. In other words, the seller of urban land is mainly selling the fruits of other people's labour.

The requirements of social justice would therefore indicate that heavy taxes should be imposed on land."

– Australian Professor of Economics, Dr. Colin Clark (1905-1989), Nov. 1974, (Remembered with the Colin Clark Memorial Lecture)

"If you don't tax that value that attaches to land,

arising from the general wealth of the economy,

the banks get it."

- Professor Michael Hudson

|

Commons sense!

This overview on Property vs Land Tax follows key insights on historical debates shaping our understanding of "The Commons" in order to show why "The Law of Rent Theorem" emerged to curtail "rent seeking" across Finance, Insurance, Real Estate -the F.I.R.E sector (Michael Hudson, 2015), in order to encourage efficient and sustainable economic development: Tax the value of land and resources instead of taxing productivity, and provide a social safety net for everyone, aka "Citizen Dividend" or Universal Basic Income (UBI), replacing pensions, via annual distribution of 'consolidated revenue' surpluses.

“Wages & earned profits rise & fall together, in the opposite direction to land prices. That's why land rent should be taxed away instead of incomes.” – Bryan Kavanagh, Land Valuer at the Australian Taxation Office (over 30 years),

The Australian National University Tax and Transfer Policy Institute provides links to a range of institutions with an active interest in tax and transfer policy.

Tax and Transfer:

- The Law of Rent Theorem refers to a self-supporting system 'flow' via 'user-fee' revenues cycling back into the community.

- A

"social wage" or "Citizen Dividend" represents an equal distribution of annual Consolidated Revenue surpluses - those funds remaining after all public services and infrastructure have been funded - which will enhance and maintain rather than degrade and destroy society.

In short, there is a need for forensic oversight on the F.I.R.E. sector's methods in achieving monopolistic exploitation of property mortgages, public services, infrastructure supply, and natural resource extraction.

"Once you've gained an understanding of basic Land Value Tax theory, you realize the mistake most people make in thinking a 'Single Tax' will hurt businesses, when it will do the opposite. It can eliminate the causes of financial insecurity on all fronts as easily as it can remove the causes of corruption. ... Hayek failed to see that the so-called real estate 'market' isn’t a real market until its land rent is captured for public purposes. With Hayek’s principles in full force, absent the collection of land rent, we’d still have property bubbles (and recessions when they burst)."

– Bryan Kavanagh, Land Valuer (Ret.) Australian Taxation Office.

In the all-time economics best-seller, Progress and Poverty,1879 (pdf), Henry George argued:

"The ownership of land is the great fundamental fact which ultimately determines the social, the political and consequently the intellectual and moral condition of a people."

According to American Economist Dr. Fred Foldvary, in The Tyranny of Billionaire Monopolists (2015), "Critics of markets lack an understanding of truly free markets" because they have failed to "think things through"

Excerpt:

"When the land rent is distributed equally among the people, and when there is no legal restriction or imposed cost on peaceful and honest enterprise, nor on the consumption of goods, then a basic income from rent, plus the easy ability to become self-employed, prevents firm owners from exploiting workers, and prevents landlords from becoming housing tyrants. The case for landlord and company tyranny by billionaires collapses when closely examined. But the critics cannot do such analysis, as they keep confusing capitalism as a free market with capitalism as today’s mixed economies. And when they do use the term “free,” they don’t delve into the natural-law ethic that gives freedom and liberty their meaning. The welfare-statist critique of markets is a failure to think things through." – Dr. Fred Foldvary, Progress, Aug. 23, 2015

|

OECD

2008 paper:

DO TAX STRUCTURES AFFECT AGGREGATE ECONOMIC GROWTH?

EMPIRICAL EVIDENCE FROM A PANEL OF OECD COUNTRIES ECONOMICS DEPARTMENT WORKING PAPERS No. 643 ranks types of taxes on their apparent growth-friendliness, and recommends, unsurprisingly, the worst-to-best order:

1) corporate income taxes,

2) personal income taxes,

3) consumption taxes,

4) “Property taxes, and particularly recurrent taxes on immovable property."

"A tax on rent would affect rent only: it would fall only on landlords and could not be shifted. The landlord could not raise the rent, because he would have unaltered the difference between the produce obtained from the least productive land in cultivation and that obtained from land of every other quality." – David Ricardo, Principles of Political Economy and Taxation (1817), Ch 10, Sect 62

"By putting an ad valorem charge on the use of land, a Georgist economy would tend to preserve the environment. It would put a halt to leapfrogging over lands held speculatively vacant and the unnecessary sprawl into hinterlands. The current regime aids the rape and pillage of the environment by treating land as a commodity and inflating speculative bubbles that burst – with the sort of economic results we're now witnessing."

– Bryan Kavanagh, Land Valuer (Ret.) Australian Tax Office. |

Back to top

The Resources of Nature Belong to Everybody

Nov 11, 2018

Progress Journal

Co-authored, together: "Public Voice"

Why It Matters: To maximize freedom, share the natural resources and immense profits made with the public. The Earth sustains all life. At its root, our economic crisis is a crises in consciousness because we see ourselves as separate from our environment, when, in reality, we’re inextricably connected to all that is. As a result, we’ve deluded ourselves into thinking that land and natural resources should be owned and then profited from by some at the expense of others. >>> more |

"If you wanted to reduce the unpopularity

of the property tax, the way to do it would simply be to provide for an effective method whereby it could be withheld at source,

in small payments and that would eliminate a large part of the objection to it."

– Milton Friedman

|

The UK's Systemic Fiscal Reform Group (SFR) is offering a choice via a 'back door' – an extremely clever choice – and very Georgist:

An option to switch from taying taxes on your income to signing a "Covenant" on the value of your land - a Covenant which remains on the property's title.

Exempted from other taxes – that's the proposition

Location Value Covenants vs Mortgages

The SFR Group is a Cambridge-based economics think tank, co-founded in 2006 by Neal Upstone, Adrian Wrigley, and Robin Smith, to study existing and alternative tax and welfare structures, their effectiveness and impact on the efficiency and stability of the economy.

>>> more here and here

Excerpt:

"With a mortgage, the money is created out of nothing by the banking system. With an LVC, the money is created out of nothing by the government. Swapping out the vast majority of mortgages in the UK is practicable. Location Value Covenants offer better deal than mortgages because:

* much less bank infrastructure to support

* no interest is paid by government on new money created

* more stable payments for home owners

* lower initial payments

In summary:

The LVC "cuts out the middleman" of the mortgage system.

Banks function of creating new money and collecting land rent off owners through variable interest is deeply damaging to the economic system. Land Value Covenants are a direct "slot-in" replacement for bank mortgages in the existing economy. Land Value Taxes *cannot* serve this transitional role. Location Value Covenants are the "Prosperity Pill" we've all been looking for! |

Back to top

Selected comments -

Responding to the above British proposal, former Australian Tax Office Land Valuer Bryan Kavanagh stated, via private discussion.

Oh, for a Georgist system that had people wanting to rush headlong into it! You can opt into the proposed system whereby, if you accept a covenant to pay rent on your title--on the locational value of your site (i.e. the rent), and pay less taxation--the payment stays with you, and succeeding purchasers of the title who will pay less for the property and less tax because of the covenant on title.

Being able to avoid other taxes if you opt in is likely to be so popular--except with the banks, of course--that many people would be keen to opt in. This would act to assist most people and tend to isolate the extremely big rent-seekers. It has two main benefits: it is optional--therefore, those who complain about it don't have to join the system--and it concomitantly reduces the taxes of those who opt in (and the land price payments of future purchasers of the property).

... if there are a number of ways of implementing significant land value capture, Land Value Covenants (LVC) being optional, but clearly beneficial to the vast majority of people, must surely rank near the top and be worthy of investigation? I'm no expert on LVC, but can't find any holes in it as an implementation alternative. For a while, there'd be two markets, but pretty early down the track when young people are looking for a home, they'd surely be seeking one with an LVC on its title, because of the relatively insignificant land value. Would that not eventually leave those who didn't wish to opt into the system out on a limb?

|

Back to top

Empty homes:

The economic reasons behind investors keeping properties vacant

Cameron Murray Ph.D.

April 4, 2017

Domain Media

Excerpt:

Prosper Australia has for years been conducting research into how many of Australia’s 9.8 million homes are left vacant. Its major finding is that of the 1.7 million homes in greater Melbourne alone, about 82,000 are vacant, or 4.8 per cent. That research has been cited by a recent United Nations study on the pernicious effects of the financialisation of the housing sector, and has likely been a key reason for the adoption of a vacant housing tax, and probably in Canada as well. It is timely, therefore, to consider some of the economic and practical realities of vacant housing.

Why keep property vacant?

What gets lost in the hype is this important question. Very few people understand the economic rationality behind leaving homes vacant, as the common sense view is that a vacant home is always costly since it is forgoing rental income for its owner. >>> more

|

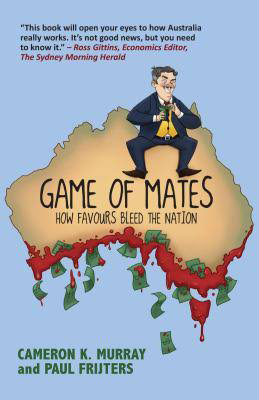

|

While we are distracted by mythical battles in the Game of Thrones, we are being robbed in the real world “Game of Mates” where the well-connected clip the wages and profits of the hard working. Murray and Frijters provide an entertaining and well researched expose of how privilege and rent-seeking dominates the Australian economy, enriching the Mates in the Game while robbing the rest. And they propose how to end the Game. And they name real names too. This is an explosive and essential book for all Australians. Except the Mates." – Professor Steve Keen

Fresh Economic Thinking

New ideas and analysis by Dr Cameron K. Murray

18 April, 2021

Why I am anti-anti-zoning.

I have fairly unique views on zoning, housing supply and prices. Here they are.

Excerpt:

Is zoning good?

The principle of zoning and land use regulation is very good and something I support. In practice, a lot of zoning and planning controls generally are designed poorly. I'm a big fan of simple rules.... It was my job to help councils follow the required procedure and approve these modelled fees. ... This system has been in place now for a decade, and it functions well enough. Its simplicity is a huge advantage, and across the planning system, there are similar gains from simplicity. (This surprise policy change also allowed me to demonstrate that these charges do not add to the price of housing)

- I am a fan of the following process for managing land use controls.

- Periodic reviews (each decade) of local planning schemes.

- Extensive community input into these schemes, perhaps with a citizen jury having the final say.

- Reviews to require some minimum zoned capacity unless there are strong reasons not to (not every area needs to accommodate housing growth).

- Strict adherence to the scheme between reviews.

- Few zones with simple controls (e.g. height, floor area ratio, setbacks, and use types).

- A simple, fast and cheap paths for applications that meet the code.

- A longer path for applications that do not meet the code, which allows for community input into the decision.

- A mechanism for capturing value from changes of use (adopt the ACT betterment tax).

- Across most of Australia, planning schemes generally follow this basic structure, though with limited value capture. >>>more

Game of Mates:

How Favours Bleed the Nation (2017)

by Cameron K. Murray and Paul Frijters

Description

James is our most mundane villain. His victim is Bruce, our typical Aussie, who bleeds from the hip pocket because of James’ actions. Game of Mates tells a tale of economic theft across major sectors of Australia’s economy, showing how James and his group of well-connected Mates siphon off billions from the economy to line their own pockets. In property, mining, transport, banking, superannuation, and many more sectors, James and his Mates cooperate to steal huge chunks of the economic pie for themselves. If you want to know how much this costs the nation, how it is done, and what we can do about it, Game of Mates is the book for you.

Review: Game of Mates

Want to stop land corruption? Take away the honeypot

Reviewed by Michael Pascoe

28 April 2017

Sydney Morning Herald

Excerpt: One of the great mismatches in our economy is how little property developers are accused of giving to politicians from time to time, and the massive amounts politicians gift to the developers – some $11 billion a year, according to a new book by two Queensland economists. ...

At its heart, Game of Mates attempts to nail the nation's growing inequality, seeing the well-off as using the law, politics and their connections to further their interests at everyone else's expense.

Some of that is complicated, some is not. The solution to the rorting of land rezoning and planning is in the latter category. >>> more

|

Back to top

3 FACTS FOR POLITICIANS & ECONOMISTS

By Bryan Kavanagh, Land Valuer (Ret.) Australian Tax Office (ATO)

1. Extractive incomes are literally counter-productive.

What are ‘extractive’ incomes? They’re what economists call ‘economic rents’ or unearned incomes, sometimes called ‘super-profits’, viz, over and above normal profits. They need to be taxed away.

Examples: Land prices represent the private capitalisation of land rent, and banks use volatile land prices as part of their ‘security’ for mortgages. To the extent that bank have an interest in inflating land prices, they are rent-seekers. People investing in real estate for capital gain are also rent-seeking speculators, as are corporate miners who fail to pay half their net profits before tax, depreciation and amortisation to the Australian people for the right to remove our national resources. It’s a partnership with the Australian people, Gina and others!

2. Taxing wages and profits are literally counter-productive.

Unlike extractive incomes, in generating real wealth, people and companies have worked for their wages and profits: they’ve been earned. They’re thereforethe genuine ‘private property’ and shouldn’t be taxed.

3. Governments don’t require ‘revenue’ (or to borrow) in order to spend on productive national investment.

Government spending comes before taxation. The currency of the nation is protected from inflation when governments tax away rent-seeking incomes.

|

The Unplumbed Revenue Potential of Land,

Part 3: ATCOR (All Taxes Come Out of Rents)

by Professor Mason Gaffney (1923-2020)

Georgist Journal, Issue #103, Autumn 2005

When we lower taxes, the revenue base is not lost, but shifted to land rents and values, which can then yield more taxes.

This is most obvious with taxes on buildings. When we exempt buildings, and raise tax rates on the land under them, we are still taxing the same real estate; we are just taxing it in a different way. We will show that this “different way” actually raises the revenue capacity of real estate by a large factor. There is much recent historical experience with exempting buildings from the property tax, in whole or part. It has shown that builders offer more for land, and sellers demand more, when the new buildings are to be untaxed. The effect on revenue is the same as taxing prospective new buildings before they are even built, even though the new buildings are not to be taxed at all.

Land value is what the bare land would sell for. It is specifically and immediately most sensitive to taxes on new buildings, and on land sales, as well as to new and more stringent building code requirements or zoning that often discriminate against new buildings. Where new buildings are “coded” more severely than old, it enhances the value of the old land/building packages. This premium should be considered part of land value, and taxable as such.

We have numerous historical experiences with exempting buildings leading to land booms: New York City 1922-33, Western Canada, Hong Kong, Taiwan, Australia, South Africa, San Francisco after the fire, Chicago after the fire, California Irrigation Districts, Cleveland 1903-20, Toledo, Detroit, Portland, Seattle, Houston, San Diego.

Familiar Micro Cases >>> more |

Back to top

On the history of land as private property ...

"The assumption that land had always been treated as private property is not true. On the contrary, the common right to land has always been recognized as the primary right. Private ownership has appeared only as the result of usurpation — that is, being seized by force. The primary and persistent perception of mankind is that everyone has an equal right to land. The opinion that private property in land is necessary to society is a comparatively modern idea, as artificial and as baseless as the divine right of kings. ... Wherever we can trace the early history of society — in Europe, Asia, Africa, America, and Polynesia — land was once considered common property. All members of the community had equal rights to the use and enjoyment of the land of the community. This recognition of the common right to land did not prevent the full recognition of the exclusive right to the products of labor. Nor was it abandoned when the development of agriculture imposed the necessity of recognizing exclusive possession of land — to secure the results of labor expended in cultivating it."

– Henry George, Progress and Poverty (1879), Ch. 29.

"The equal right of all men to the use of land is as clear as their equal right to breath the air - it is a right proclaimed by the fact of their existence." – Henry George

|

Back to top

Why, with technology and national wealth rapidly advancing, do the vast majority live in poverty?

The Annotated Works of Henry George, (2017) demonstrates why "Land" distribution became such a key matter during the late 1800s economic crisis in the USA, Ireland, and Australia.

Look Inside via Amazon.com

Summary excerpt, Vol. 1:

Henry George (1839–1897) rose to fame as a social reformer and economist amid the industrial and intellectual turbulence of the late nineteenth century. His best-selling Progress and Poverty (1879) captures the ravages of privileged monopolies and the woes of industrialization in a language of eloquent indignation. His reform agenda resonates as powerfully today as it did in the Gilded Age, and his impassioned prose and compelling thought inspired such diverse figures as Leo Tolstoy, John Dewey, Sun Yat-Sen, Winston Churchill, and Albert Einstein. >>> more

“Land is a significant omission from economic models"

"homelessness is unsustainable"

British author Brian J Hodgkinson explained why “Land is a significant omission from economic models" in his Nov. 14, 2013 Letter to the Editor of Financial Times:

Sir, The debate about “the new economics” (editorial, November 13) fails to note the key omission from current models of the economy: the place of land as a separate factor of production.

Land, defined as all natural resources, should not be regarded as capital, since it is not a result of production and, unlike capital, creates rent, largely from location values. Its omission from economic models has meant that land values have been ignored, even though these were the principal element in the house price rises that led to the creation of the subprime mortgages and other financial assets that caused the crisis of 2008.

A new analysis to include land, both in micro and macro models, would bring the whole subject into line with observable facts, including also the huge disparities of wealth in modern economies. - Brian J Hodgkinson, Oxford, UK

Henry George, the Transatlantic Irish, and Their Times

(2009), by American historian Kenneth C. Wenzer, Ph.D.

Excerpt from

Introduction -

[Henry George's] ... fame and fall were due to a temporary alliance with the American Irish Catholics who were agitating for the land war in Ireland and social change in their new homeland. So significant was this tidal wave of support that it swamped the American consciousness in the late 1870s and early 1880s including prelates of the Roman Catholic Church, some of whom were conservatively inclined. George astutely navigated the waters by working with the radical editor of "The Irish World", Patrick Ford. But then George made a politically awkward friendship with Father Edward McGlynn, an ardent supporter of modernism and the single tax, who was a constant irritant to the church hierarchy and subsequently excommunicated. The issues that McGlynn raised rocked the American Catholic Church and the Vatican itself. The counter-campaign waged by the church and devout Irish Catholics blocked McGlynn and put an end to George's fleeting success.

. . .

Henry George came to maturity at a time when the simplicity and democratic values that had governed the United States were under assault. Slow and placid rhythms of life prevailed, but their future would be brief. Factories were flinging mass-produced goods into an economy accustomed to expecting a hat or a pair of shoes to come to an individual consumer from a local craftsman, or perhaps from a merchant drawing craft products from small shops at some distance. Canals and then rail tracks had begun slicing into the backcountry. Cities were taking on a character Americans might more quickly have expected of ancient times: overcrowded housing, uncollected sewage, the ravages of cholera, and the spread of street crime. – Dr Kenneth C. Wenzer, 2009 Vol. 27B, pp. xv, xviii

The Ultimate Tax Reform:

Public Revenue from Land Rent (pdf)

By Fred E. Foldvary, Ph.D. San Jose State University

January 2006

Excerpt

“Even a relatively flat income tax imposes what economists call a “deadweight loss” or “excess burden” on society. Taxes on productive activity increase the price of labor or goods beyond economic costs, and so reduce the quantity provided. This reduction in production, income, and investment is a misallocation of resources. Resources are wasted because they do not go to where they are most wanted. We can reduce this excess burden by reducing taxes, but changing the type of tax can also reduce this deadweight loss. Economists recognize that if we tap for public revenue a resource whose quantity is fixed, the excess burden disappears. The tax does not reduce the supply and does not increase prices.

This might seem too good to be true, but in fact, such a resource exists everywhere and is indispensable for human action. That resource is land. The supply is fixed, immobile, and inherently visible. If land value is taxed, the land will not flee, shrink, or hide. A tax on land value has no deadweight loss. If the purpose of tax reform is to reduce the extra costs imposed on the economy, a tax on land value does this far better than any tax on income or goods.

If you currently pay property taxes on a home or business, you may be shaking your head at this point. You are not eager to read about a proposal that would make your taxes even more onerous. But the proposal here is not to increase taxes but to shift and reduce taxation. Unless you own a valuable vacant lot, the proposal presented below would most likely reduce your total tax bill, since if fully implemented it abolishes taxes on your earnings and spending, and it also eliminates the portion of real property taxes that falls on buildings and other improvements.

The tax reform presented here is not new. It has been working to some degree in many cities and countries around the world. The idea probably obtained its greatest popularity in the U.S. in the late 1800s, when the economist Henry George analyzed taxing land value and untaxing labor and capital in his book, Progress and Poverty.

Many economists have since then expanded on George’s writing, examining both the theory and the evidence. There is even a “Henry George Theorem,” which proves that in a community with optimal population, the land rent equals the value of the community’s public goods. Modern economics thus affirms George’s theory in a more comprehensive and more rigorous form, although the empirical question of how much revenue could be obtained from rent would benefit from more research ... pp 1-2

Visit the New York Public Library, Archives & Manuscripts:

Henry George Papers ca. 1840-1950

See dedicated page: Remembering Henry George HERE

|

Back to top

Go to: Land, Taxes, Poverty |